suvs money affordable car insurance cheaper auto insurance

suvs money affordable car insurance cheaper auto insurance

On the click here other hand, a vehicle driver with an inadequate driving document need to decide for a reduced deductible. In addition, many states have actually made driving records available online.

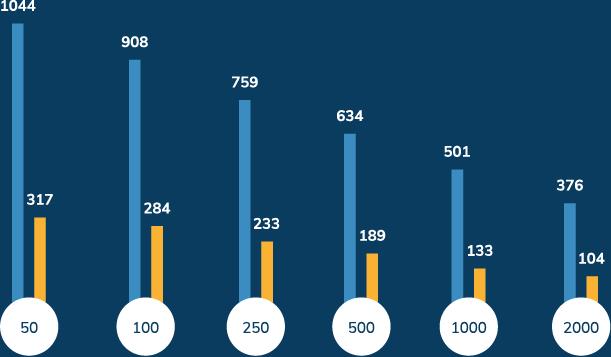

Selecting the appropriate deductible quantity, relying on your demands and financial circumstance, can assist you conserve hundreds on your auto insurance plan (suvs). If you select in between a car insurance policy deductible of 500 or 1000, think about numerous aspects highlighted in this short article and review your options with your insurance policy agent (low cost auto).

insured car cheap car auto insurance liability

insured car cheap car auto insurance liability

Instead, do appropriate research as there are other ways to lower insurance premiums. low-cost auto insurance. Your automobile insurance representative can examine your scenario and also establish the most effective feasible savings choices for you. What is much better: a higher or reduced insurance deductible for auto insurance policy? If your auto insurance policy spending plan is tight, a high-deductible plan may be better for you.

What is the finest collision insurance deductible? It's ideal to have a $500 crash deductible unless you have a big quantity of savings.

You may have wondered previously, just how do insurance policy deductibles function? What are the different kinds of deductibles, and does the amount affect the month-to-month settlements? In straightforward terms, an insurance deductible is the amount of cash you dedicate to pay of pocket prior to your insurance policy business starts to pay you any benefits - low cost auto (car insurance) (car).

Unknown Facts About How Much Can You Save By Raising Your Auto Insurance ...

: Claim you have an insurance deductible of $500 and you rear end somebody. If you are the at-fault driver, the coverage will have to originate from your accident plan - liability. If your damages are $2000, you will certainly need to pay the $500 insurance deductible and also after that your insurance will certainly pay the remaining $1500 (accident).

You would certainly pay the complete $400 and also your insurance policy would not pay anything, since you did not reach the insurance deductible. Different sorts of deductibles: An insurance deductible can be a set amount or a percentage of the complete price of your insurance claim. vans. The example over makes use of a fixed deductible. This number is something you will set with your insurer prior to you sign your policy.

If you pick a greater insurance deductible your costs rate will certainly be lower - insurance company. Just remember, if you choose a high insurance deductible, you require to have at least that much cash saved in case you obtain right into a crash and need to pay it. cheap. Where to discover your deductible: If you already have an insurance plan, you can discover the amount of your insurance deductible on the main page of your plan, called the (low cost auto).

vehicle affordable auto insurance insurance insured car

vehicle affordable auto insurance insurance insured car

It is near the front of your plan. risks. Examine to see what your deductible is, as well as if you have any problem finding it or any type of other questions whatsoever, call an Infinity agent at! - business insurance.

car credit score cheap insurance auto

car credit score cheap insurance auto

What is an insurance coverage deductible? An insurance coverage deductible is the quantity of cash you have to pay from your very own pocket before your insurance policy coverage kicks in. insured car.